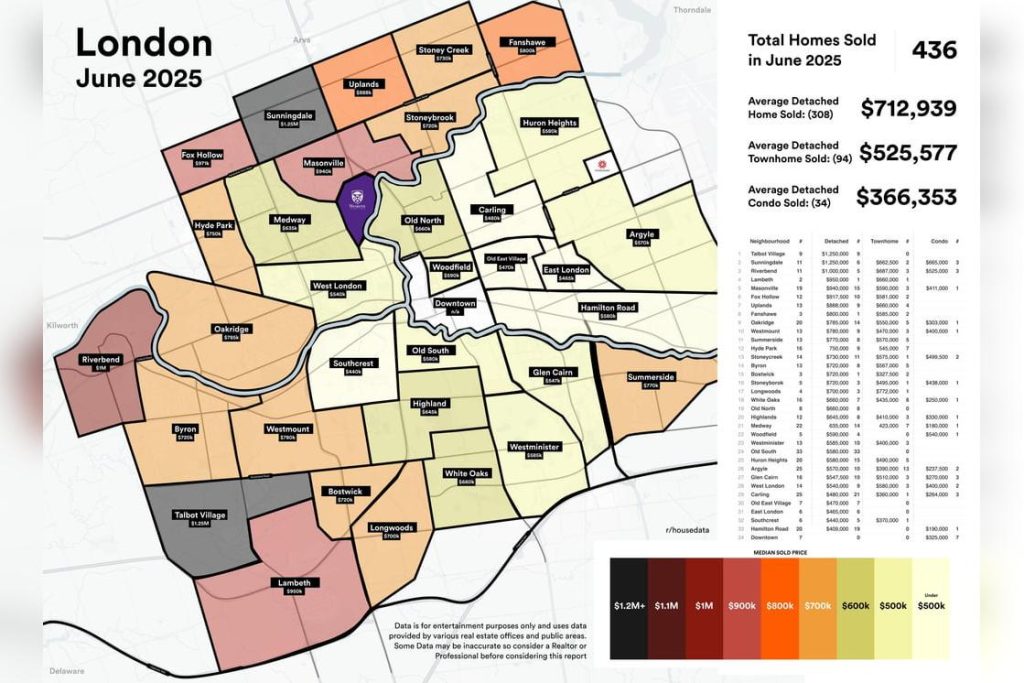

If you’ve been wondering what’s really happening in London’s housing market, fresh data from June 2025 reveals some pretty interesting patterns across the city’s neighbourhoods.

A comprehensive breakdown of every house sale in London last month shows the median detached home sold for $712,939, based on 308 sales across the city. That’s actually down from where prices were sitting just six months ago, when the average was hovering around $750,000 in December 2024.

The townhome market landed at a median of $525,577 with 94 sales, while condos came in at $366,353 across 34 transactions. What’s particularly wild is how much neighbourhood really matters when it comes to pricing.

Some parts of London are still hanging onto that sub-$500,000 detached home dream. Areas like Old South are seeing homes move for around $580,000, though locals point out many of these are smaller, century-old properties that have been hitting the market recently.

The data gets even more interesting when you look at where the action actually is. Old South led the pack with 33 detached home sales, followed by Carling with 25 and Masonville with 15. Meanwhile, some of the pricier neighbourhoods like Longwoods and Stoneybrook only saw three sales each.

For context, London’s housing rollercoaster has been pretty intense lately. Back in 2019, the average detached home was sitting around $500,000. Things got absolutely bonkers in 2021 and 2022 when prices shot north of $900,000, making June’s numbers feel almost reasonable by comparison.

The monthly breakdown from 2024 shows just how volatile things have been. Prices bounced between $692,000 and $750,887 throughout the year, with an average of about $730,000 across those ten months.

What’s creating some of the price differences across neighbourhoods comes down to housing stock. Old South is packed with century-old character homes, while areas like Byron mix older properties with new builds. Then you’ve got Talbot Village and Riverbend, where about 90% of homes were built in the last five to ten years.

The semi-detached market is getting lumped in with townhomes in this data, though there’s talk of splitting those categories in future reports since they serve pretty different buyer segments.

Even with these numbers, some families are finding the math challenging. One local mentioned having a household income of $175,000 with savings ready to go, but still only qualifying for around $300,000, which doesn’t leave many options in today’s market.

Compared to other Ontario markets, London is still holding onto its reputation as one of the more accessible cities for homeownership. While condos in Metro Vancouver are pushing past $700,000, London’s condo market is sitting at roughly half that price point.